Semi-Truck Financing | The Power of FICO Score

When it comes to financing anything from a new truck to a used trailer, your FICO credit score plays an important role in the terms you get. Let us look at the financing statistics for transactions done in 2019 to see just what a better credit score can do for you.

The Credit Score of an Owner-Operator

A credit score can be the difference between a double-digit and a single-digit loan on your truck, or the difference as to whether or not you get a loan at all. What credit score does an owner-operator need to put another truck on the road and raise his revenue?

Statistics

In mid-January 2020, OverDrive Online conducted a poll that says owner-operators tend to have fairly solid credit: 79% of owner-operators have a credit score above 650, and 46% have a credit score above 650!

But not so fast: this data is inaccurate. If you have a lower credit score than 650, here are some aspects of this poll that you might want to consider before feeling down:

- The poll was multiple choice: people could choose any option they wanted. Someone might “remember” that their credit score is higher than it actually is.

- The poll, based on the title, assumes everyone who votes in an owner-operator, but there was no gatekeeping for the poll: any person could go to the website and vote.

- Overdrive Online’s readership base tends to lean towards more owner-operators who take a particular interest in reading about the industry, and as such do not accurately portray the industry as a whole.

- Just because someone’s credit score is higher or lower does not mean they are looking for financing.

- These numbers do not portray whether or not the people were able to obtain financing.

Surely there is a more accurate method of finding out the credit score needed to have a good chance of financing.

TopMark Statistics

As a financing company, we at TopMark Funding keep track of the statistics regarding the applications we receive and the loans we give out. Our data resolves the five issues the OverDrive Online poll could not prevent.

- The only way to have your result count was to have your credit (softly) pulled, so fabricating scores is impossible.

- Only people who applied and authorized the soft credit check are part of the results, so the gatekeeping standards are above and beyond just clicking on an option and hitting “submit”.

- TopMark’s base is towards people interested in obtaining commercial vehicle financing, which may cause the results to skew from the true national representation, but is almost certainly closer than polling a viewership base of truckers strongly interested in the industry as a whole.

- Everyone in the data wanted to obtain financing, otherwise, they would not have filled out the application.

- We can tell who obtained financing.

Here is what we found from TopMark Funding’s statistics for 2019:

- The average FICO score for a funded transaction was 677

- The median FICO score of all funded transactions for 2019 was 678.

- The most common application FICO score for funded transactions was 679.

- The fact that the median and average are close to one another shows that the data points for funded loans are (most often) not skewed in either direction above or below the high 670s.

- The highest FICO score for a deal was 817; the lowest, 331.

- The lowest FICO score is an outlier; the second-lowest FICO score is 459, over 100 points higher. In contrast, the second-highest FICO score is 812, a five-point difference.

- Of all applications in 2019, those at or above 677 were over three times as likely to be funded than those with credit scores below 677.

- There are over three times as many total applications below 677 than at or above 677 (but you could infer that from the above bullet points as well, since below 677 has roughly the same number of funded transactions but a third of the funding rate).

The Credit Score of a Fleet Owner

We are going to ramp things up this time around and compare the credit and funding of owner-operators versus fleet owners and see if there is any connection between vehicle ownership and credit score.

Company Drivers, Owner-Operators, and Fleet Owners

As a financing company, we at TopMark Funding keep track of the statistics regarding the applications we receive and the loans we give out. Our data is solid; we only collect application statistics on people who have the intention of obtaining financing, and not from asking people to estimate their credit score(s) but rather through a soft credit check to obtain a definitive answer. We take privacy seriously; all of the data points we provide about credit scores will be presented anonymously.

If we’re going to do any form of statistical analysis of TopMark Funding funding, we need to define our words so that they are clear. Some people consider a fleet owner to be 2 or more vehicles, others may consider it 3. To make sure we get a solid picture of the connection between truck ownership count and FICO score, we will refer to a company driver as someone with 0 trucks looking to get their first big rig (or other commercial vehicles such as a dump truck or cement mixer, we finance those too!), an Owner-Operator as 1 or 2 commercial vehicles, and a Fleet Owner as 3 or more commercial vehicles.

Credit Score Comparisons

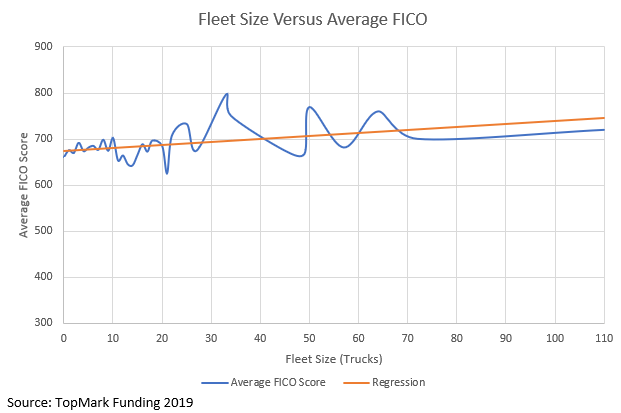

Of all funded deals and averaging the FICO of all people who had deals funded in 2019 based on the number of trucks they own, we found information which can be found in this graph:

The graph shows that the average FICO score is somewhat correlated with fleet size, but not by much (there is a correlation of .434, for you math nerds out there). This makes sense, as someone who has gone through the financing experience a few times has proven themselves to be a capable lendee who can pay back his obligations, but it is also not the only factor that determines a credit score (others include credit utilization, age of credit, diversification of credit account types, and so forth).

Splitting the funded deals into our three predefined categories, we find:

- Company drivers (or those looking to become owner-operators) (0 trucks in the fleet) tend to get terms that they deem agreeable when they have about 673 FICO.

- Owner-operators (1-2 trucks in the fleet) find terms of financing agreeable when they have 674 FICO.

- Fleet owners (3 or more trucks in the fleet) average out at 691 for their loan terms.

Credit Score and No Down Payment

“I want to get financing for my business equipment. My credit is Poor/Fair/Good/Very Good/Excellent, and I want no down payment, or barring that, as low of a down payment as possible. What options are open for me? How high of a credit score is needed for no down payment?”

We at TopMark Funding get asked this a lot, and since the customer is always right, we thought it would be good to write an article and derive a ballpark answer for people.

Down Payment from the Financial Representative’s Mouth

We talked with Nick Gilmore, Senior Sale Manager here at TopMark Funding, about the link between credit score and down payment.

“It’s not the score alone, it’s the content of the credit as well,” Nick said. “Typically, we are looking for stronger credit profiles, comprised of well-paid installment debt. Homeownership is a key factor to strengthening a profile as well.”

“We take a number of factors into consideration when viewing a client’s profile. This includes the number of payments made on installment tradelines, how far back the credit history goes, and how many recent hard inquiries have been made on the credit.”

“We have different programs based on creditworthiness. When people ask about a down payment, what they really should be asking about is the upfront cost. This would include placement fees and upfront payments that reduce the length of the term.”

Statistics

Beyond TopMark’s financial expertise, we also have the details of all funded transactions at our disposal. Here is an aggregation of funded transactions in 2019, anonymously comparing FICO scores with upfront payment % of the equipment purchase deals. Note that for groups of people that had the same FICO score, we took the average of their upfront cost percentages, otherwise the graph would be difficult if not impossible to read.

Here is what we learn from this graph:

- Credit score has a weak negative correlation (-0.4766 for you math nerds out there) with the average upfront percentage. As the credit score goes up, the percentage of the total due upfront tends to go down.

- Using regression (the dotted trendline), we find that an increase in credit score of one point tends to lower the percent due upfront by 0.056%. This may seem marginal, but an increase from 600 to 650 reduces the average upfront percentage by just a little over 2.8%. If the total deal for a slightly used Freightliner were $121,000, then that 2.8% change means $3,388 less out of your pocket.

- Having a low credit score does not automatically disqualify you from getting a loan. At the same time, unless you like the idea of paying more than half upfront, it literally pays to have a higher credit score.

- Having a high credit score does not automatically mean you will not have to pay money upfront, people with 506 FICO have gotten 0% upfront and people with 806 FICO have gotten 20% upfront, but it certainly increases your odds. Once you pass 600 FICO, the upfront percentage becomes much more manageable.

Credit Score and Approval Amount

Another factor to consider when it comes to financing is the amount of money that you need to be loaned to you to get the equipment you require. If you cannot get approval for the amount you need to finance the new truck or used truck, it may be difficult to find the financing you need, but TopMark Funding certainly has options for you. Using TopMark Funding’s financing statistics for 2019, perhaps we can estimate how much more money we can get for a commercial vehicle with a higher credit score of 100, 50, or even 1 more point?

Statistics

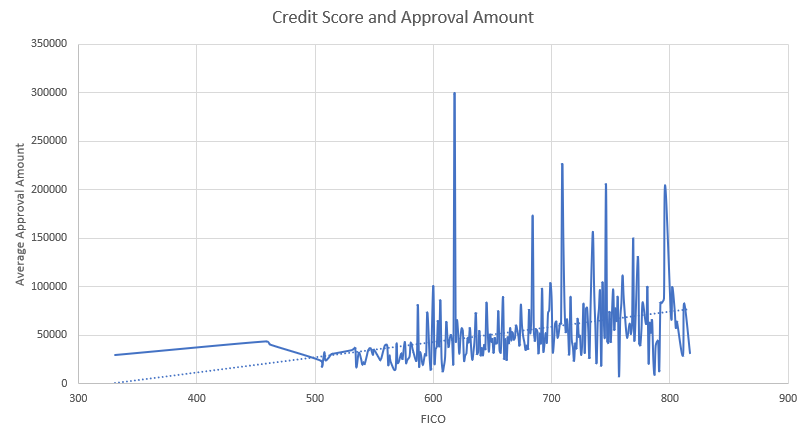

Beyond TopMark’s financial expertise, we also have the details of all funded transactions at our disposal. Here is an aggregation of funded transactions in 2019, anonymously comparing FICO scores with the total approval amount of the equipment purchase deals. Before we do some number crunching to draw conclusions, here are some things to consider:

- For groups of people that had the same FICO score, we took the average of their approval amount, otherwise the graph would be difficult if not impossible to read.

- Approval amount and the amount used to finance are two different things. If someone approves you for $100,000 and you want to purchase a $75,000 truck, that is a difference of $25,000. Being approved for more than you need is unlikely, but not uncommon.

- The statistics come from over 900 data points. They are funded transactions, meaning a smaller amount of data but higher quality as the clients were ultimately satisfied with their approval results based on their credit.

Here is what we find:

- There is a weak positive correlation (.365) between credit score and the approval amount. As credit score rises, the approval amount tends to rise, though that is not always the case.

- Using regression (the dotted trendline), we find people with a credit score raised by one point get approved for a loan that is $157 more. That might not seem like much, but a credit score increase from 400 to 800 would mean $62,840 more in approved financing, on average. The dotted trendline is not an end-all-be-all for approval amount, as evident by 400 FICO and below on the graph, but it gives us a good rule of thumb.

- The average approval amount for FICO score 618 is a massive outlier (seen on the graph as stretching far beyond all the other data points). If we remove this outlier from the equation, the correlation and regression both rise (.427 and 164.83, respectively).

Conclusion

With our 2019 funding data, we see that having a credit score at or above 677 will make your terms more likely to be acceptable (lower down payment, longer duration, lower interest rate, etc.), but even people with a credit score near the bottom can still find financing, albeit rare.

Truck loans are self-securing, meaning that a person who already has his eyes on an expensive, new truck is more likely to be approved for more money than someone who is financing a big rig in need of an overhaul, as the financing company has their loan backed by a stronger investment.

Another thing to consider is just because a business is approved for a large amount does not mean a person should take out a loan that large. Larger loans tend to be paid over a longer period, meaning a larger interest rate and more paid in interest over the term of the loan.

Regardless of your credit score, TopMark Funding does soft credit checks, meaning it cannot hurt to try. Do not let this distribution discourage you if your score is between 300 and 676, and, if you don’t like the terms you get for a lease or loan, work hard to raise your credit.

CHECK OUT THESE OTHER GREAT TRUCKING ARTICLES

- Mack Trucks to Reenter Medium-Duty Market

- How to Grow Your Trucking Company

- Trucking in 2020 and Beyond

- Benefits of Leasing a Semi-Truck

ABOUT TOPMARK FUNDING

TopMark Funding is a top-rated semi-truck and equipment financing company located in Roseville, CA. We specialize in commercial trucking and heavy equipment. Our mission is to become your long-term financial partner by helping you grow your trucking business and fleet.

We’re not here for the short-term, we’re on the long-haul with you!

We have financing options for semi-trucks, commercial trucks, trailers, and small businesses. We have great rates, low down payments, and flexible monthly payments regardless of credit history.

Learn more about: Semi-Truck Financing

Fill out the contact form or give us a call at (866) 627-6644. One of our truck financing specialists will contact you as soon as possible to go over your truck lease needs and learn more about you and your business financing goals.